How Behavioral Analytics Works: An Onboarding Workflow Comparison

Due to its fraud detection capabilities alone, behavioral analytics drastically improves fraud mitigation by streamlining the entire stack and reducing pressure on fraud teams. It provides a new layer of data that’s crucial in stopping some of today’s biggest fraud threats. But the additional insights from behavioral analytics can have an equally important effect on customer experience and overall workflow efficiency.

In onboarding flows, I’ve seen behavioral analytics implemented in lots of different ways to achieve different goals. There’s no one way to use it, but there are some best practices to follow to get the most out of it. Let’s walk through behavioral analytics’ impact at different spots in an onboarding flow.

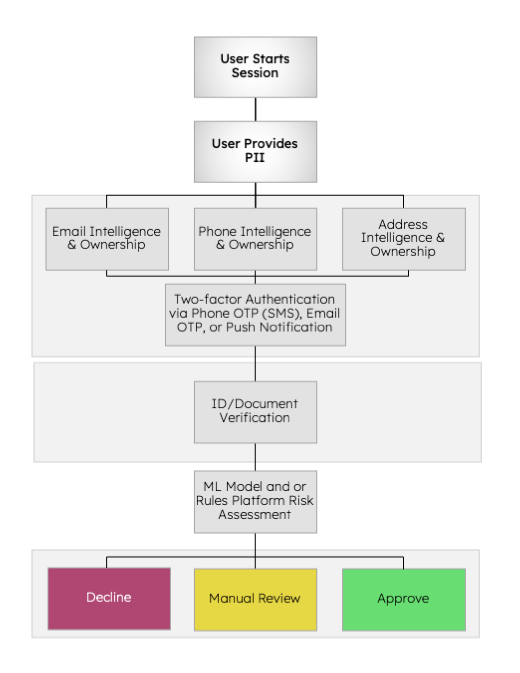

First, let’s look at an example onboarding workflow without behavioral analytics.

In this example, you’re wholly reliant on the user’s PII for an initial idea of how risky the user is. While PII has its place, it has a few pitfalls. For example, if a fraudster is using high-quality stolen or synthetic identity data, they can bypass this stage with ease. A more intensive step-up or heavy-handed identity check (such as document verification or manual review) might catch them, but it also adds a lot of friction to legitimate applicants (and a lot of extra time and money to your workflow). Even with these step-ups, if the fraudster has the right tools and knowledge of this flow and its triggers, they can work their way into your business’ ecosystem (and even if these checks do stop the fraudster, you’ve already spent money on additional data calls for a user who never should’ve gotten this far in the first place).

It’s as susceptible to fraudsters as it is frustrating for genuine customers. Say someone enters this flow hoping to legitimately do business with you. For all we know at this point, this person could be using fraudulent identity data, so the only option is to force them through the same checks that you would a fraudster. If the user doesn’t have their MFA device handy or can’t track down the right documents for verification, they may give up and take their business elsewhere. In short: this rigid, one-size-fits-all flow is inviting fraud and costing you good business.

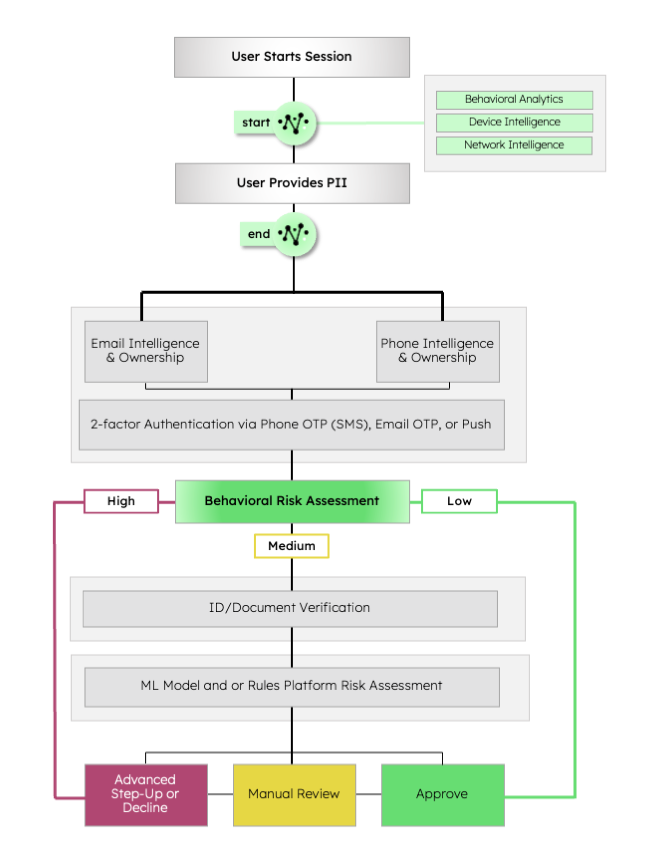

Reasonable Practice: Call Behavior Second

Now, let’s add behavioral analytics to this flow. We’ll place it after an MFA verification, but before document verification — this isn’t ideal (I’ll share why in a moment), but it’s not out of the ordinary for a team that’s still figuring out how to maximize fraud stack effectiveness.

Behavioral data is collected as soon as the user’s session begins, and, in this scenario, the behavioral analytics API is called after the user inputs an email or phone verification code. With behavioral analytics providing a net-new source of information, you now have a comprehensive view of any user’s level of risk. And that risk level can inform subsequent checks. You can fast-track genuine users without document verification, outright decline risky users without triggering an unnecessary data call, and route those who need more information to the appropriate step-up path. (Want to read how this looks in practice? Read our Addi case study, where behavioral analytics cut verification time in half for the majority of users).

On the user’s end, everything looks the same: there’s no additional friction, and genuine users experience even fewer barriers by bypassing extra checks. The issue with this approach, though, is that you’re still spending money on email/phone verification for fraudsters and leaving a common drop-off point (MFA verification) in the way of genuine customers.

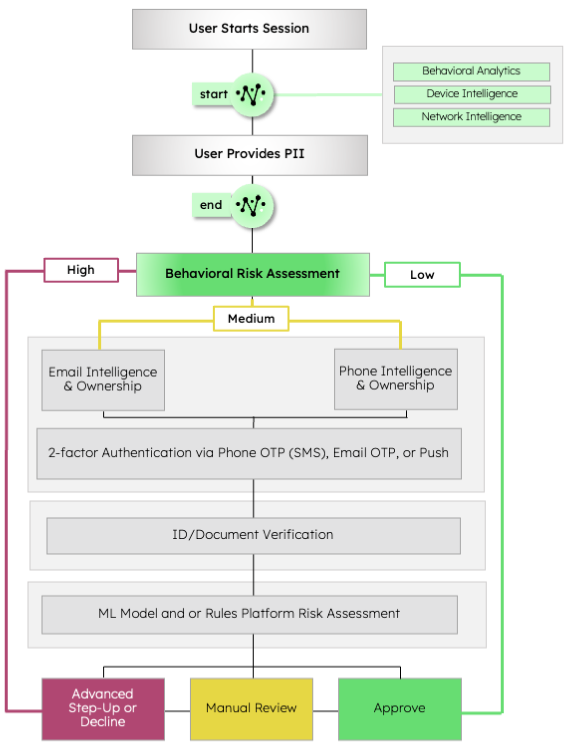

Best Practice: Call Behavior First

The best approach is to call behavioral analytics at the very top of the funnel, before any other data calls.

When you move behavioral analytics to the very top of the fraud stack, you can now inform decisioning for every downstream check. For genuine users, they can now be pushed through the flow with ease and get right to doing business with you. For fraudsters, they’re blocked before they even have a chance to trigger another check or cause damage. This improved top-of-funnel decisioning boosts conversion rates, increases fraud capture and maximizes your fraud stack’s efficiency.

The Power of Behavioral Analytics

You’ve seen the impact of behavioral analytics in an onboarding flow and how valuable it is as a top-of-funnel fraud detection tool. But truly maximizing behavioral analytics’ impact requires a defined plan and the right partner; for more on how to successfully bring it into your fraud stack, read our 2025 Buyer’s Guide to Behavioral Analytics for Fraud Prevention.