What Is—and Isn’t—Behavioral Analytics in Fraud Detection?

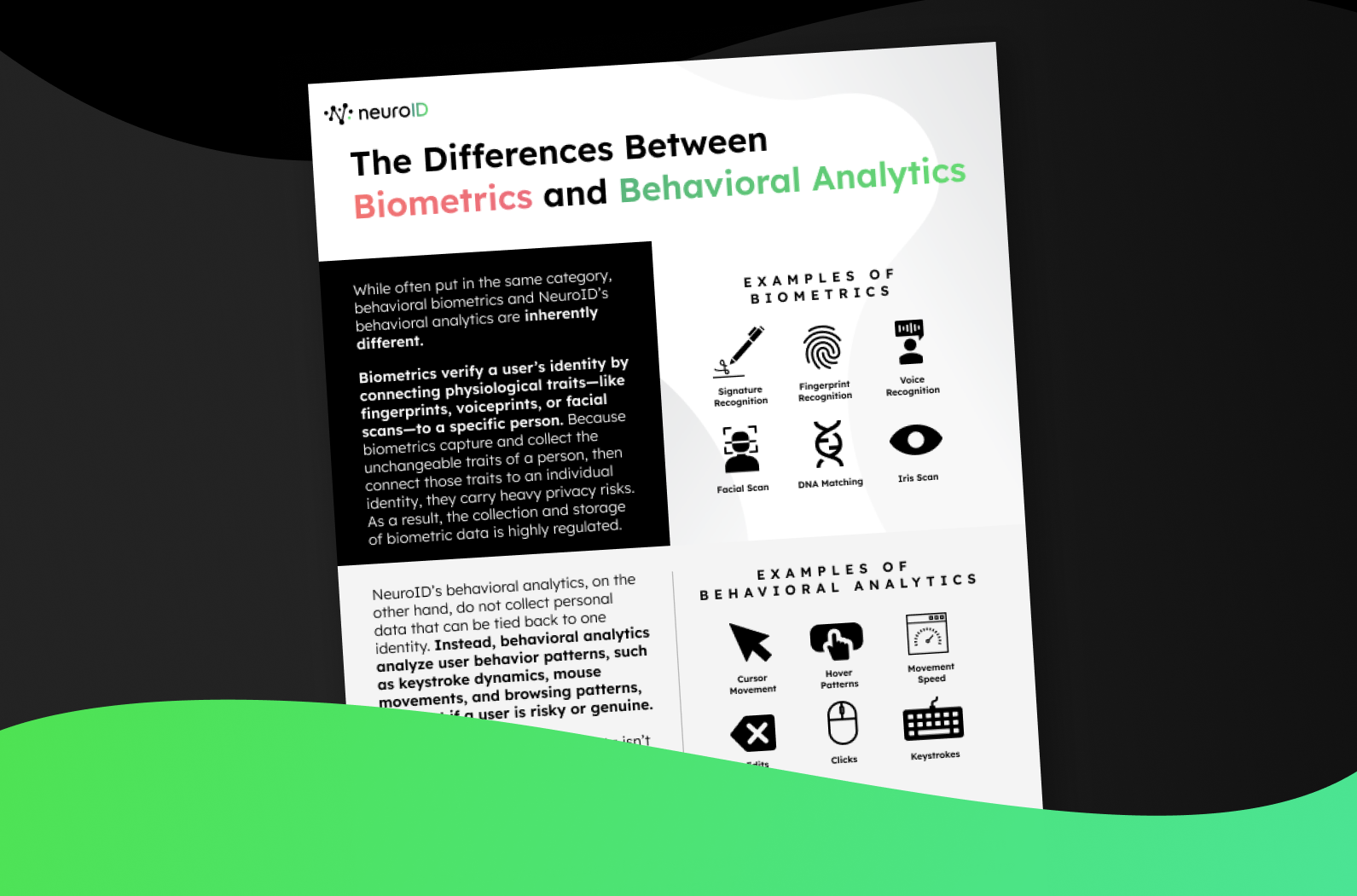

You’ve likely used biometrics today, whether you know it or not. At their simplest, “biometrics” are any kind of “unique physical characteristics, such as fingerprints, that can be used for automated recognition.” This can be the everyday facial scan used to open your phone, or the hyper-advanced iris scan—a favorite of futuristic sci-fi movies now being used in real-life.

Biometrics connect a person’s data to who they are: that facial scan is connecting your phone to your identity as its owner. Behavioral analytics, on the other hand, connect a user’s behavior to their intention—not their identity.

While biometrics track characteristics, behavioral analytics track distinct actions. For example, with NeuroID behavioral analytics, every time a person inputs information, clicks in a box, edits a field, and even hovers over something before clicking on it or adding the information to it, those actions are tracked. But unlike biometrics, this data isn’t collected or used to connect to a single identity. Instead, it’s information that businesses can use to learn more about the experience and the intentions of someone on the site—which, in turn, can determine how that customer experience goes: fraudulent intent? Take them to step-ups! Friendly intent? Fast-track their journey!

The Complicated Future of Biometrics

Through 10+ years of R&D, 100M+ analyzed onboarding journeys, and 1 trillion translated behavioral data points, NeuroID has redefined behavioral analytics to support customer onboarding journeys for a faster, friction-smart, and finance-friendly process. As the leader of assessing human-digital interactions, NeuroID provides patented behavioral analytics solutions that interpret human digital behavior to determine if a user is who they say they are. Unlike behavioral analytics, which requires no data capture, biometrics require collecting and storing personal data—with regulations and severe penalties that are continuing to evolve across states and nations. Behavior is where we hit our home runs: biometrics are a whole other ballgame, and one we’re not interested in playing.

The Digital Behavioral Differentiator

Since everything interaction has moved online, we are missing the human connection that would give us visual clues if someone were a fraudster, or if someone is getting frustrated filling out an application. Behavioral analytics are the digital answer to that human connection. By using behavioral analytics on your website and applications, you can see the user’s digital body language, filling in the lost human elements. You can assess the human, not the data. You gain enhanced fraud protection at the top of your digital identity stack, as NeuroID’s software can detect when someone has nefarious intentions. You improve your application process, reducing genuine application friction and increasing your conversion rate. And you can better track your customer journey, noting where levels of interest drop along the way.

This is all from data you already capture, simply tracking interactions on your site—no PII or biometrics involved.

Increase Conversions with Behavioral Analytics

With NeuroID, you can qualitatively and quantitatively measure customer experience at scale, down to individual field interactions, using ultra-lightweight integrations and collecting no personally identifiable information nor biometric data. You get to see how customers experience your application and can easily champion data-driven approaches for improvement. NeuroID makes it simple to find the areas where your customers get stuck or frustrated by scoring every customer interaction and highlighting those form fields. Once you have identified those areas, you can replay the interactions that are linked to those friction points and implement improvements accordingly.

Enhanced Fraud Protection

If you could watch a user over their shoulder, do you think you would be able to tell whether they were committing fraud or not? What if they could not seem to remember their phone number? What if they have to erase and retype their name several times? What if they appear to be hesitating over fields that should be easy for a legitimate user to answer? What if they are running a bot that enters data faster than a human could? Armed with this information about a user’s behavior, you could direct suspicious users to step-up authentication, flag the account for back-end review, block the transaction, or use the behavior patterns to identify additional suspicious users. NeuroID’s behavioral analytics needs as few as three fields to get up to 70% of confirmed fraud cases, which helps eliminate the need for step-up authentication and its associated cost.

When using NeuroID, you can find and identify fraudsters more easily, without putting so much friction into the process that you alienate your genuine users. Determining if someone actually exists or they are who they claim to be is not easy, but by exposing NeuroID’s behavioral insights to back-end agents and processes, suddenly you have a window into the customer’s behavior and intent, making those questions far easier to answer. You can reduce the friction points that make you lose real users while still identifying fraudulent accounts.

Improve User Experience At Scale

Unlike biometrics, NeuroID does not collect any information the customer inputs in the app, nor does NeuroID connect its behavioral analytics to a specific person. It only monitors how they interact—if they take two minutes to input their phone number, if they retype their name multiple times, if the input is so fast that it is impossible that a human wrote it, and more—all of which will help you eliminate fraudulent applicants before they even hit submit.