Consumer Financing

Combat unauthorized access to credit report data, business-logic abuse, family fraud, & more.

Get faster, more accurate fraud detection.

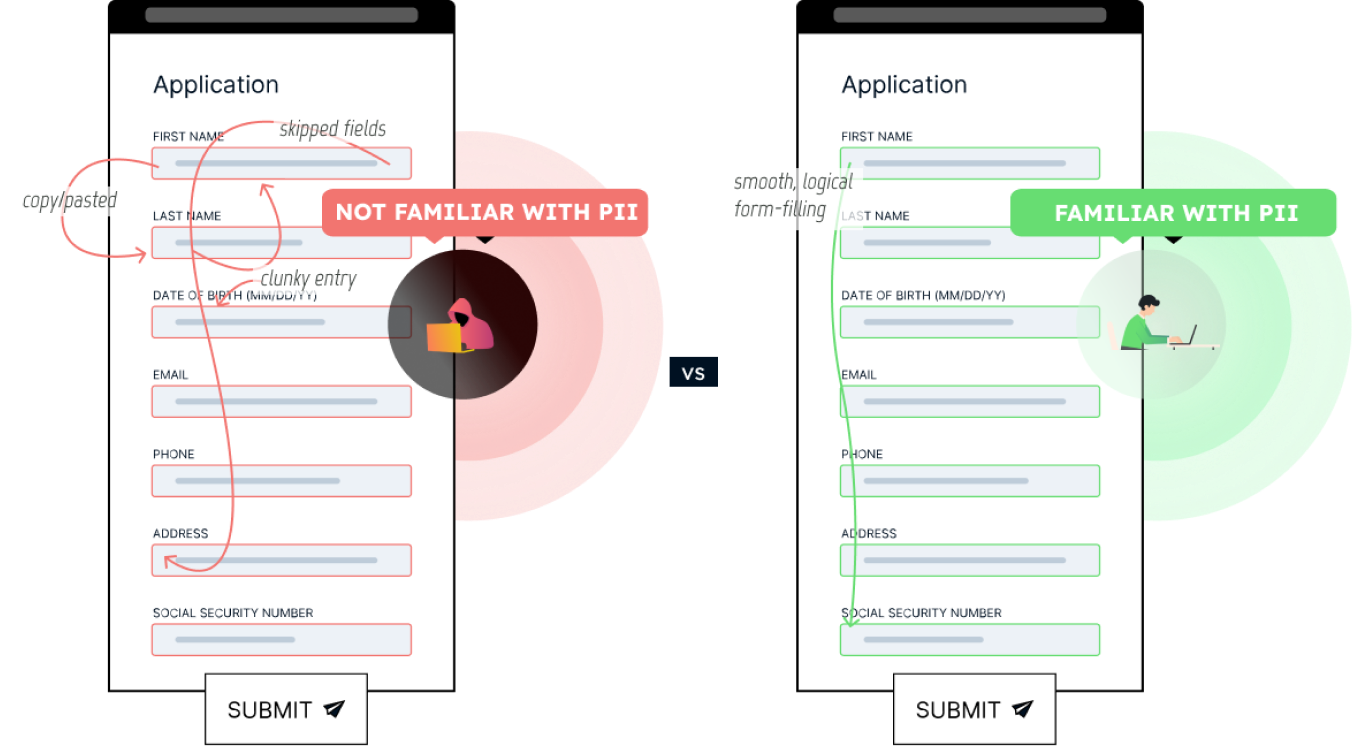

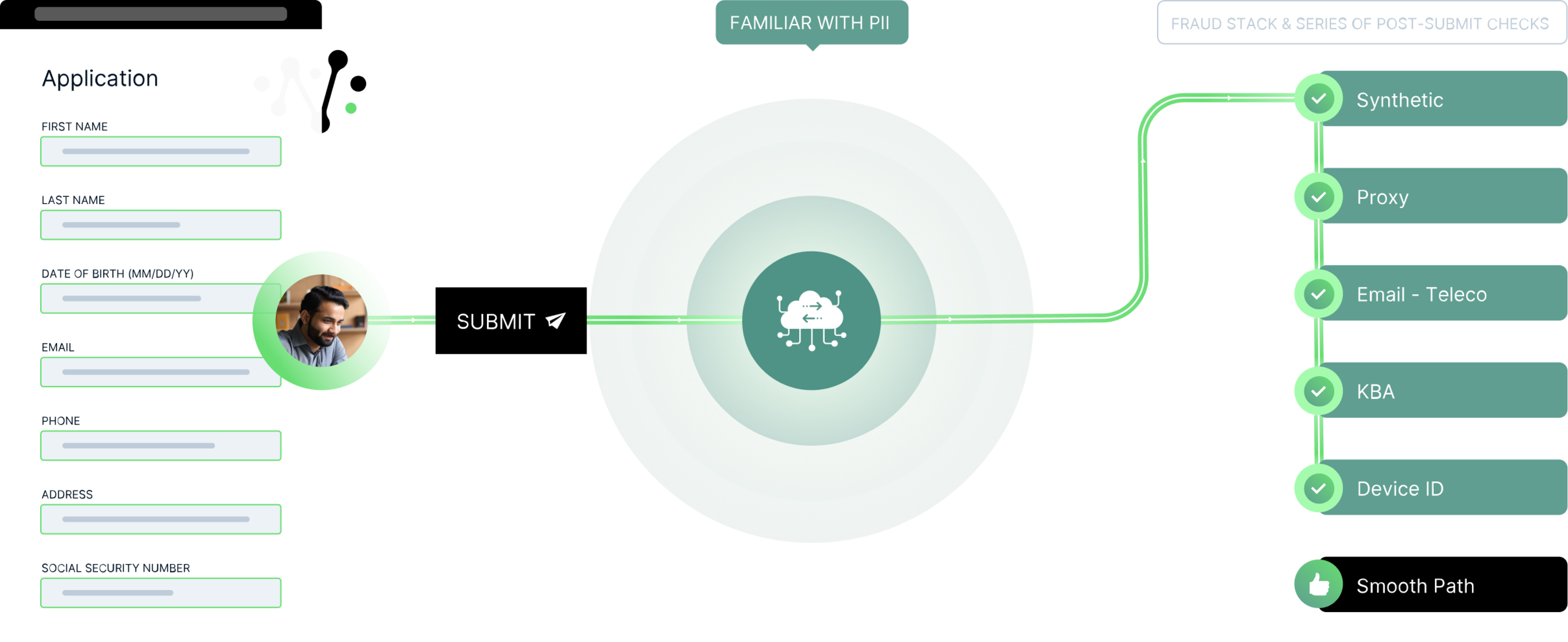

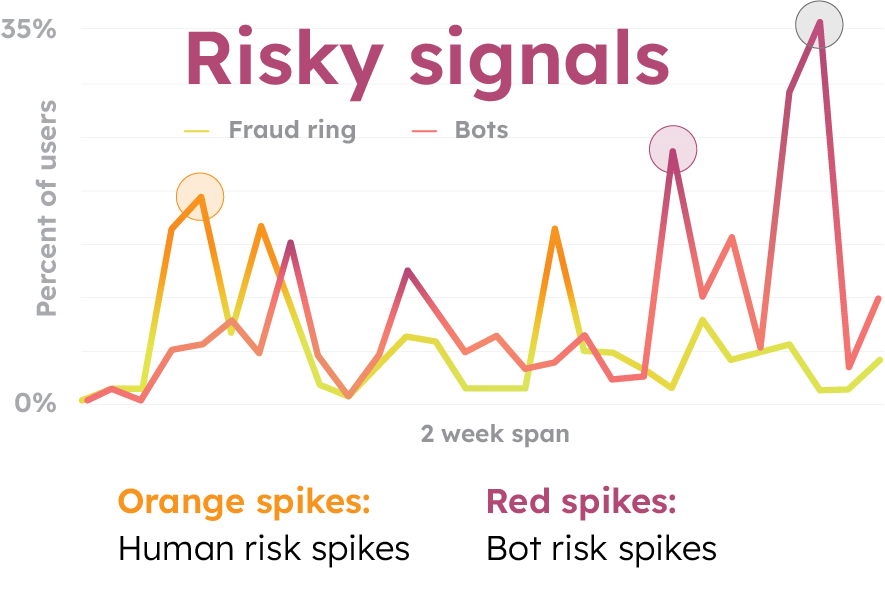

Flag risky applicants sooner with razor-sharp precision, catching fraud threats that would otherwise be overlooked. From business-logic abuse, such as the penny-drop scheme, to unauthorized access attempts, NeuroID’s real-time behavioral analytics gives you an impenetrable first line of defense to protecting revenue and maintaining credibility.

Reduce manual reviews & fraud mitigation costs.

Adding NeuroID’s behavioral analytics as your front-line of defense streamlines the rest of your fraud prevention efforts. You can fine-tune all of your fraud solutions for greater accuracy in its individual specialty, giving you more confidence in approval/denial and fewer costly step-ups and reviews.

Tailor signals to your unique needs.

Your business has intricate fraud prevention needs. NeuroID customizes your rules to your specific challenges, creating unrivaled fraud detection for online brokerages, robo-advisors, and investment management platforms. This leads to faster verification times for trustworthy users (and more deterministic rejections for fraudsters). You can also better pinpoint stages where users might abandon your process, ensuring smoother experiences.

Top Finance Organizations Trust NeuroID to Stop Fraud Faster

Challenges We Solve For Consumer Finance

Discover Our Most Popular Resources

Defend Your Organization Against Fraud

From onboarding to account management, stop fraud before it happens with real time metrics and alerts from NeuroID. Speak with one of our fraud experts to learn how.