Behavioral Analytics in the Wild: 3 NeuroID Use Cases In Practice

What fraud looks like—and the methods you use to combat it—are ever-evolving. That’s why NeuroID’s behavioral analytics were built to flexibly adapt and out-pace evolving fraudster approaches. Behavioral analytics are uniquely suited for catching fraudsters early and providing new insights into advanced fraud tactics (both human and bot) and how they can be thwarted.

What does this look like in practice? Here are three prime use cases of how NeuroID customers have used our behavioral analytics solutions.

Use Case #1: Mitigating Fraud without Adding Unnecessary Friction

When you fight fraud, there’s a tenuous balance between adding friction that hurts customer conversions. Behavioral analytics is unique in part because of its passive, in-the-background role.

The Friction vs. Fraud Challenges

Elevate came to NeuroID for help fighting back against frequent fraud ring attacks. Even though they could see evidence of fraudulent activities during the account opening process, their single-layer security system was being overwhelmed by fraud ring blitzes. They needed a more robust approach, but didn’t want to make onboarding more difficult for the trustworthy applicants.

Facing a similar problem, Addi, a lender with customers across Latin America, had an identity verification process during onboarding that Mauro Jacome, Addi Head of Data Science, called “extremely strenuous.” “Every applicant had to take a picture of their national ID, send a selfie, sometimes even call our customer support team,” said Mauro. “It was a 7-minute process for 100% of the population.”

Still, fraudsters were finding ways around even Addi’s and Elevate’s strenuous checks. Worse, their trustworthy applicants started their onboarding with a frustrating and time-consuming experience.

The NeuroID Solution

Elevate upgraded the front of their fraud detection stack with NeuroID, which meant they could identify fraudulent applications before users even hit “submit.” That’s because NeuroID’s analytics detect when fraud ring behaviors are being used to launch an attack.

“More checks are obviously better from a fraud perspective, especially more checks that don’t add friction,” said Ryan Prince, Data Scientist Manager for Elevate. “Most people are familiar with [multifactor] authentication, where we send a text to verify yourself, but it would be even better to have additional checks that don’t add any friction. Just analyzing the behavior throughout the application is so helpful because we’re able to cut out that fraud without additional [hurdles on] the customer side.”

Addi also saw massive improvements with NeuroID. Addi’s new verification process was cut in half for 60% of their applicants, while also stopping more fraud.

The Results

Both Addi and Elevate achieved similar results: they stopped more fraud while simultaneously improving their customers’ onboarding experience. This smarter protection equals happier customers. Or as Mauro put it, “NeuroID has been a key factor in our ability to expand our risk appetite, which has been crucial to our growth. With NeuroID, we have enough information on good applicants sooner, so we can fast-track them and say ‘go ahead and get your loan, we don’t need anything else from you.’ And customers really love that.”

Use Case #2: Saving Money with Behavioral Analytics

One of the most challenging aspects of digital fraud is that the damage can be done quickly and quietly, but the clean-up is difficult and expensive.

The Challenges

For instance, a payment processor with around 3 million US customers employed a fairly standard two-step verification process during onboarding. However, fraudsters were still getting through: NeuroID’s analysis found more than 100,000 dormant fraud accounts in the payment processor’s system. The cost of manually reviewing, investigating, and deactivating these accounts were staggering, as were the collective chargeback costs.

A Top 5 Bank in the U.S. was experiencing similar onslaughts, as they consistently felt the brute force of fraud attacks, which not only overloaded their systems but added heavy expenses in fraud mitigation.

The NeuroID Solution

After working through an analysis with NeuroID, the payment processor calculated that the cost of finding, investigating, and declining fraudulent accounts amounted to roughly $10 million in combined losses and chargeback costs per year. With our help, this customer can now block high-risk applications early and stop the creation of fraudulent accounts before those costs are incurred.

The Top 5 Bank incorporated behavioral analytics to find fraud faster, and flag previously missed fraud. NeuroID’s pre-submit behavioral analytics showed the bank complex fraud attacks 4x faster than before, and found 40% more verified fraud cases that were previously approved manually.

The Results

Our customers know that identifying fraudulent behavior early is the key to more efficient and cost-effective fraud protection. NeuroID enables you to stop fraudulent activities before they make an expensive mess of your data, your resources, and your bottom line.

Use Case #3: Detecting Complex Bot Attacks with Behavioral Analytics

We recently conducted a study that analyzed bot attack patterns experienced by 15 of our customers over a four-month period. Our findings indicate that although fraud tactics typically fit into a few general categories, these tactics—from simple to sophisticated—are leveraged in different ways, and often all at once. It’s why we say you’re fighting a multifront war on fraud.

The Challenge

Digital businesses must constantly contend with a variety of attacks on their systems: known and unknown; individual and concerted; manual and automated.

As part of our study, we analyzed suspicious activity on one sample customer’s account sign-up page. Over a three week period, this payment processor experienced a two-fold increase in both human users and bots. This activity raised their risky human activity metric from 11% to 18% over that time frame.

Those “risky” applicants were incredibly productive: one user was linked to 22 merchant tokens originating from the same browser. Further analysis showed an alarming uptick in automated users (31%) in a single day. It seemed that a concerted effort was underway to pressure test and overcome various stages in the sign-up process, paving the way for a devastating, high-velocity bot attack.

The NeuroID Solution

Behavioral analytics were crucial to stopping this sophisticated operation before the attack was launched. A key indicator in this attack preparation was that the “risky” applicants flagged by NeuroID were completing application forms at an incredible pace—well above what a human can do. While some questionable human behaviors were also detected—for instance, extensive use of the ‘paste’ command for standard information, like name and email address—most signaled some degree of automation.

It’s likely that a multi-stage plan was being executed, starting with human-performed testing and probing and scaling up to a highly-automated bot attack. Thankfully, understanding these suspicious behaviors enabled our customer to detect patterns of fraud early and stop them before the attack occurred.

The Results

Fraudsters and the bots they program to supercharge their attacks are growing increasingly sophisticated. NeuroID’s behavioral analytics are designed to identify both risky human behavior and automated patterns that either mimic human behavior or use velocity to inflict maximum damage.

What Can Behavioral Analytics Do For You?

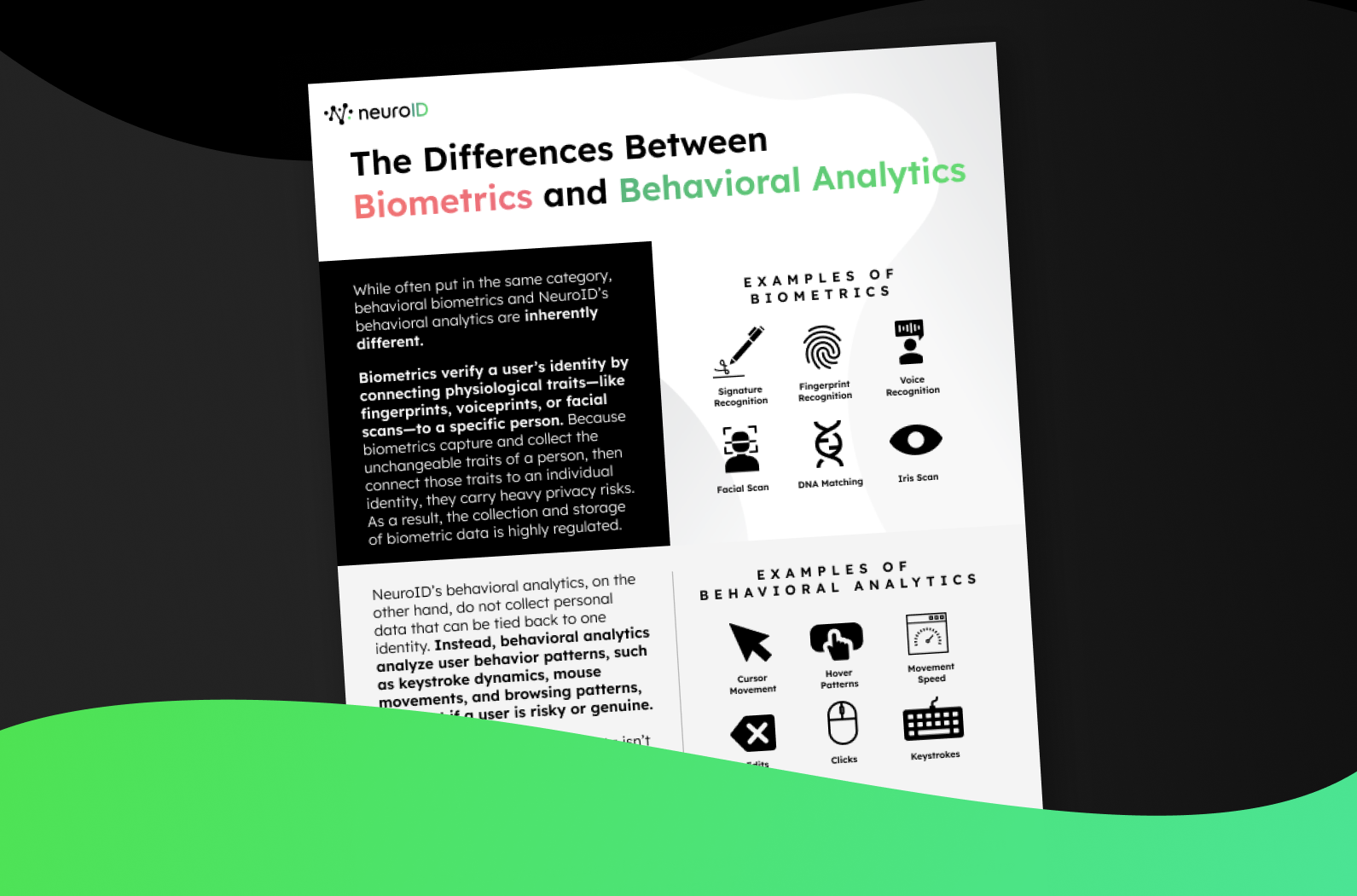

NeuroID’s behavioral analytics are distinct from anything in your fraud stack, because they don’t rely on historical data, credit histories, physical biometrics, liveness tests, or anything else that requires the collection of PII.

Instead, NeuroID adds a wholly unique and valuable layer of insights by looking at digital behavior with a focus on how the human (or bot) behind the screen enters information. And by looking at that behavior, we help you assess whether or not they are trustworthy enough to become a customer of yours.

Fighting fraud, fast-tracking customers, scaling growth, and more: behavioral analytics can help. Let us show you how.