Busting 3 Myths About Behavioral Analytics for Fraud Prevention

Able to stand up to next-generation bots and other forms of advanced third-party fraud, behavioral analytics is quickly becoming a must-have for businesses. But when I talk to fraud professionals exploring behavioral analytics, they often have misconceptions – or flat-out mistruths – about what behavioral tools can and can’t do. Here are the three biggest behavioral analytics myths that I’m happy to dispel:

Myth #1: Behavioral analytics is an identity verification tool

Generally speaking, fraud prevention teams implement behavioral analytics for the same reason as any other tool in their fraud stack: to stop fraudsters. But behavioral analytics goes about that goal differently than biometrics or other identity verification tools, and the insights drawn from behavioral analytics are net new insights, unique to anything that other tools reveal.

The biggest differentiator is that behavioral analytics is not identity verification – rather, behavioral analytics evaluates risk through users’ behaviors. In other words, behavioral analytics doesn’t identify who a user is but assesses whether a user is risky or not based on how they’re interacting with your site. It may seem like a granular difference, but it’s one that has major impacts on fraud workflows and customers’ experiences.

I’ve heard the follow up question to this countless times: why do I need behavioral analytics if I already have a robust fraud stack? You might not. But we’ve seen businesses have great success using behavioral analytics in conjunction with other tools. Commonly a top-of-funnel tool, behavioral analytics can sit upstream of more heavy-handed identity checks, blocking out fraudsters before they can trigger those more expensive tools and providing a net-new layer of information without any additional friction for users. This approach has streamlined onboarding processes for digital businesses and drastically improved the effectiveness of even the world’s most sophisticated fraud stacks.

Myth #2: Behavioral analytics is difficult to implement – and even harder to evaluate

Because behavioral analytics adds an entirely new layer of information and data collection to most businesses’ fraud stacks, many assume it’s a hassle to integrate and find the right spot for it amongst their other tools. Often, this isn’t the case at all – with NeuroID, all it takes is a single Javascript installation to start collecting data.

The most difficult part of effectively implementing a behavioral analytics solution is deciding how and when to call it in your onboarding flow. Most of the time, the key is to call it as early as possible. Behavioral analytics is at its best as a top-of-funnel solution where it can weed out fraudsters early and inform downstream checks. The effectiveness of behavioral analytics is less clear when it’s buried under more intensive checks.

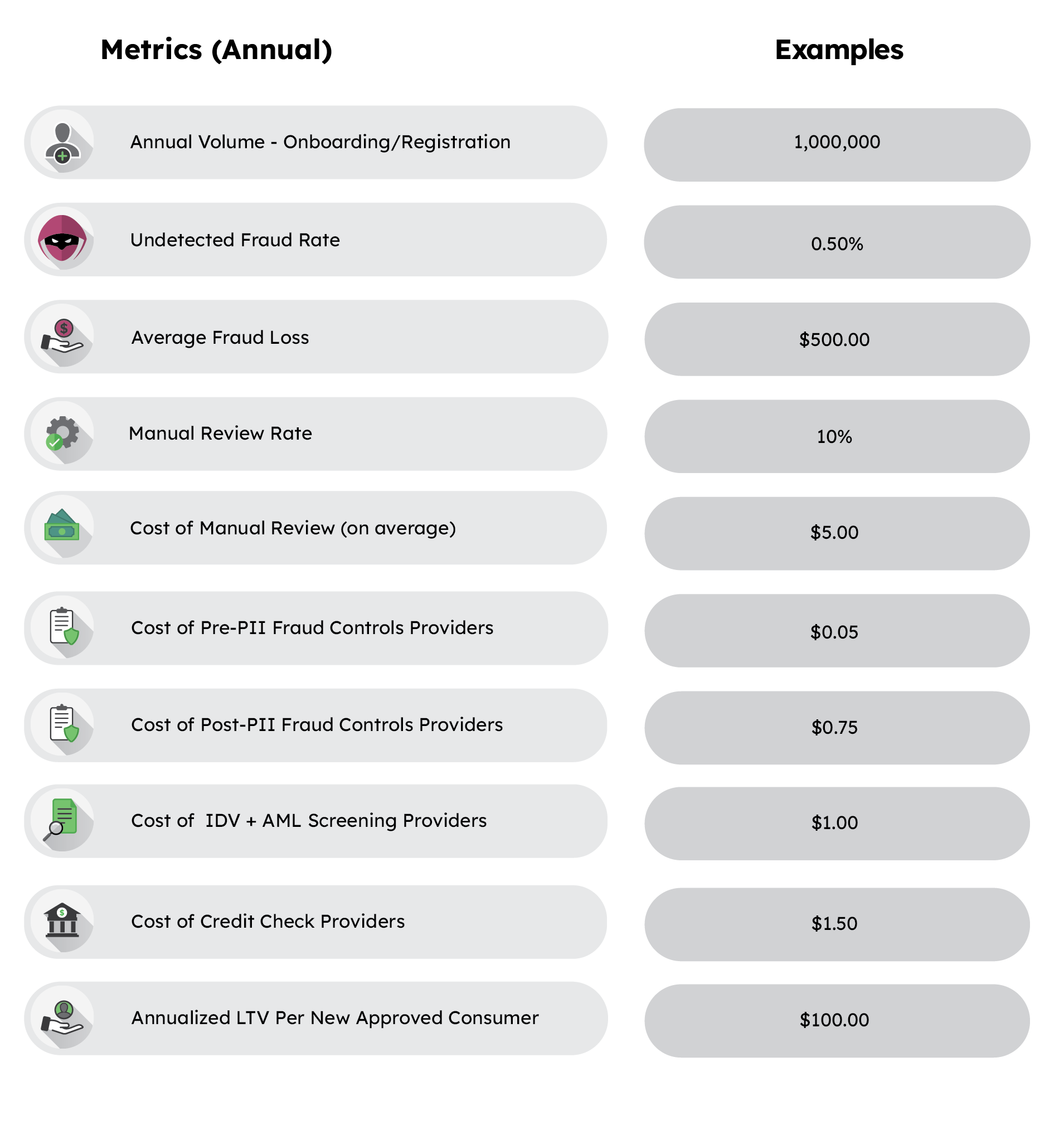

With behavior at the top of your fraud funnel, evaluating its ROI is relatively straightforward. Before trialing a solution, identify the following metrics:

Reevaluate those metrics after your trial. The results should be able to tell you how behavioral analytics impacted your fraud detection rate, false positive rate and more. Use your average fraud losses and customer lifetime value to extrapolate those numbers into loss savings and/or added revenue, and it should be clear how your behavioral solution is impacting your business’ bottom line.

Myth #3: All behavioral analytics providers are the same

Some return more signals than others, but at their core, most behavior providers look at similar information: keystrokes, cursor movements, clicks, etc. We find that many fraud professionals struggle to see what separates one vendor from another (or what’s stopping them from building behavior in-house).

There are a lot of factors. Different behavioral analytics providers specialize in varying areas and prioritize behavior differently alongside other signals. Some look at basic interaction data to augment other signals that are weighted heavier in their models. Others rely primarily on behavioral profiling for existing users. And the most established providers have loads of foundational data to build their solutions upon (something that can’t be replicated by an in-house creation).

For example, at NeuroID, we are and always have been behavior-first. We triangulate our behavioral signals with device and network data, but the core of our solution and models are our in-depth behavioral analytics. We’re able to recognize risky behavior in new users as they open accounts, while also connecting unique data entry patterns to login credentials for protection against account takeovers and scams. If you’re looking for a behavioral analytics solution that can recognize stolen and synthetic identities, fraud rings and sophisticated bots anywhere in the user lifecycle, NeuroID is a good place to start.

Deciding if behavioral analytics is the right addition to your fraud stack (and which vendor to go with) can be a challenge. Find the answers to your biggest questions in our 2025 Buyer’s Guide to Behavioral Analytics for Fraud Prevention, or reach out to our experts to walk through your businesses’ needs and how behavioral analytics can help.