The Banking Deposits Brawl: 3 Ways the Banking Crisis is Redefining the Challenger vs. Incumbent Battlefield

With yet another stunning failure of a bank making headlines recently, it’s clear that the collapses of SVB, Signature, and now First Republic Bank will continue to cause anxiety for customers long into the future. On top of that, the financial world is entering the new digital bank-run era, where viral panic spreads faster than the industry and regulators can respond. Where do we go from here, and what does this fast-evolving landscape mean for banks both new and old trying to secure their growth?

The Challenger Bank Conundrum: Building Trust in a Time of Chaos

In today’s volatile banking landscape, consumers are more anxious—and empowered—than ever before. Panic-infused social media snippets shoot lightning fast around the world, and money can be moved in-and-out of banks with a click of a button. With cryptocurrencies and other fast-evolving economic disruptions already challenging the way we think about money—one of the most personal, important, and universal components of life—it’s no wonder consumers are a bit freaked out by headlines using the words meltdown, collapse, and catastrophic in the same sentence as “banking.”

It doesn’t matter if the person reading the headline is not actually invested in the collapsing banks making headlines, the is-my-money-safe panic sets in all the same. And if the answer isn’t a resounding YES, they know they can easily go somewhere else. The collapses of SVB, Signature, and First Republic bank don’t directly impact most every-day banking customers, and yet a real-time crisis of confidence is rippling across digital-first banking, as consumers whip-lash their money back into traditional, too-big-to-fail banks:

- Bank of America received more than $15M in new deposits as a direct result of the SVB and Signature failure, driven by consumers seeking safety after the headline-making collapse hurt confidence in the safety of digital-based and other smaller lenders.

- Wells Fargo and Citigroup experienced a swell of deposits directly related to SVB’s woes, with direct deposits coming in the tens of billions of dollars.

- Citi even fast-tracked their opening of retail, small business lending, and wealth management accounts in order to keep up with the frenzy of demand.

These collapses were a major win for traditional banks, who have spent the past few years fighting through their “kodak moment” of digital world evolution, while digital-first challengers went on the offensive with smoother online onboarding, approvals, one-stop shops, and user-friendly processes. The frighteningly fast failures of SVB, Signature, and First Republic are game-changing for both opponents.

Fraudsters and Frenetic Onboarding: Who Wins on the New Playing Field?

The rising and falling of banking fortunes proves that savvy banking consumers can move their money quickly. And we already know that fraudsters will follow that money: any fintech knows that an influx of prospective fraudsters immediately follows any publicly announced new funding round, large-scale marketing campaign, or headline-making launch.

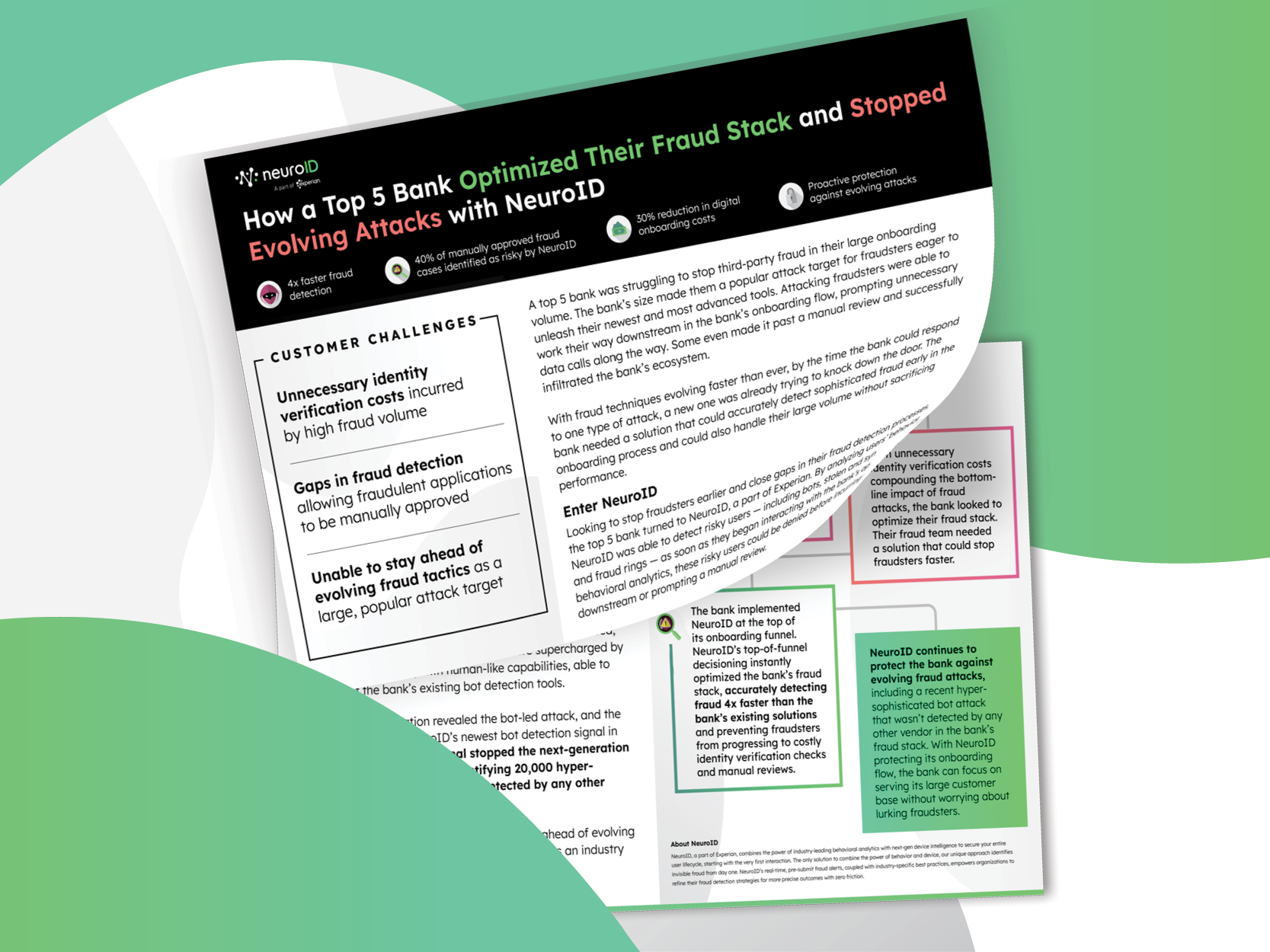

But this fraud uptick often catches traditional banks off-guard. For example, the recent rapid onboarding of deposit accounts for traditional banks: fraud rings undoubtedly noticed the headlines about big banks getting big bucks. And they’d know these banks were likely to be averse to adding friction or causing delays to potential customers during a high traffic period, rather than looking for fraudsters (click here to read a case study about this very issue). This is a common strategy NeuroID sees with sophisticated fraud ring attacks, and we’re keeping a close eye on it as the new account influx continues to grow across our client base.

Takeaway 1: As your applications swell, so will the target on your back for fraudsters. Consider if you have tools in place that can help you both:

1. Differentiate spikes in applicants to visualize fraudsters from genuine users.

2. Grow efficiently. As you attract more and more applicants, are you driving up costly PII API calls? Or are you optimizing your orchestration to only spend when and where you need to?

When you need to onboard new accounts quickly—in response to an influx of new deposit accounts being opened due to a run on banks, for example—if you don’t already have the right tools in place to ensure you’re onboarding genuine customers, then you’ll either fall behind as customers bounce due to too much friction, or be hit with an influx of fraud attacks.

Fraud is in Lock-Step with Consumers: Prepare for High Rates Both

Every fintech, challenger bank, and online lender expects a high level of fraud attacks with deposit accounts; at NeuroID we’ve seen even up to a sustained rate of 30% just as a baseline. Fraud rings have a unique brute-force attack style that far transcends even the high fraud rates expected in this fast-paced, hyper-growth industry.

Takeaway 2: A holistic traffic flow view is vital for a secure, smooth, and sustainable pace of customer onboarding. For example, by analyzing hundreds of millions of customer journeys, NeuroID’s modeling deciphers between subsegments of risky populations and the data returned to look for specific behaviors associated with fraudsters that don’t appear in risky applicants. Behavior-based applicant-level fraud protection is key to identifying fraud attacks early in the process, without adding any friction to the onboarding journey. As a non-PII solution, NeuroID’s behavior-based analytics are a powerful way to build in more risk management without more red tape.

The Conversion Experience is Key

The inherent risks of fast-paced growth doesn’t always come from fraudsters. In order to swiftly onboard an influx of customers, digital onboarding processes need to include smart friction and doesn’t weigh down the fraud team with manual verification processes.

As traditional banks juggle that influx of accounts, they’ll need to shift to a digital-first mentality that makes challenger banks so enticing. But chances are, the brick-and-mortar-first banks are behind on the balance of user experience and identity verification. This makes it a critical competitive point for traditional and digital banks alike.

Takeaway 3: Focus on the competitive boost of the conversion experience. If you’re a digital-first bank losing customers, it’s time to flex your native ability to meet their needs, while emphasizing that you’re trustworthy. As Deloitte recently put it: “ ‘We are not financial institutions’ historically has been a core fintech mantra heard around the industry . . . fintechs pride themselves on creating deep customer connections, navigating market trends agilely, and creating disruption for traditional competitors.” Any consumer paying attention is likely to have noticed that fintechs move faster than traditional finance behemoths. And they’re willing to overlook it, as long as that speed isn’t at the cost of security. A strong onboarding pathway, with no risk of headline-making fraud attacks, is more important than ever.

On the flip side, traditional, incumbent banks are on the slower, stodgier end when it comes to online customer onboarding—that’s often why they lose out to the younger generations looking for the best digital experience. For both ends of the spectrum, layering in friction-right digital identity verification ensures a smooth, secure onboarding experience that feels natural to the digitally-native.

The Fight-to-the-Death for Deposits

The banking world is at an inflection point, as the fight for deposits moves into the public eye in a battle royale that is literally life-or-death growth opportunity for banks of all sizes. An evolving battle requires the most sophisticated tools: the pre-submit behavioral analytics that you already capture are a sheathed sword that could be giving you a huge competitive edge. These industry leaders are ready to ride the wave of opportunity coming out of the banking crisis—are you?