Lending

Tackle the evolving challenges of lending fraud, including referral abuse and charge-back fraud.

Get faster, more accurate fraud detection.

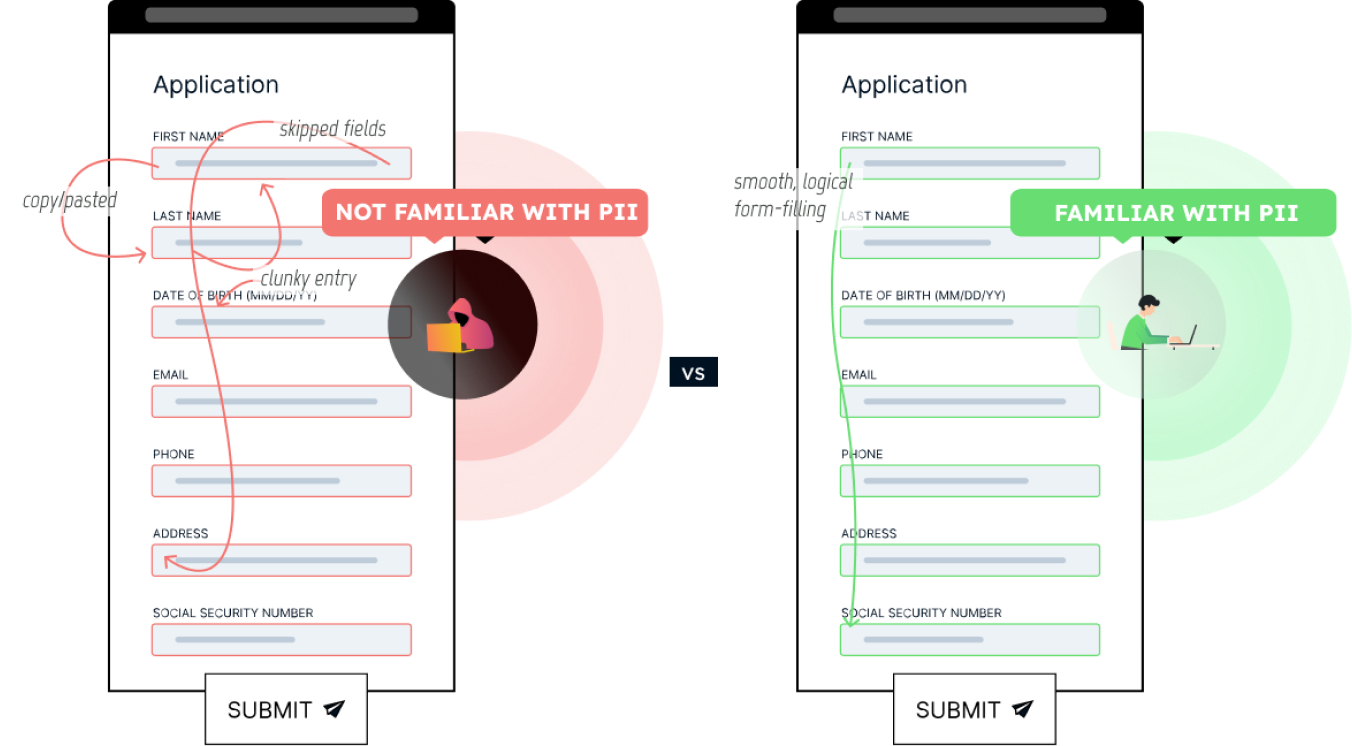

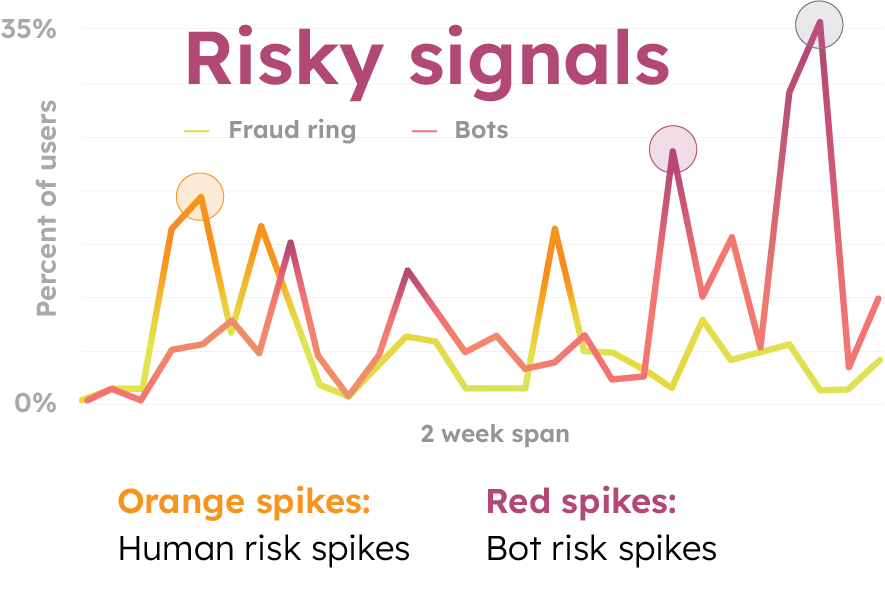

Flag risky applicants sooner with razor-sharp precision, catching fraud threats that would otherwise be overlooked. We helped Addi eliminate third-party fraud and drastically reduce bot and fraud ring attacks.

Reduce manual reviews & fraud mitigation costs.

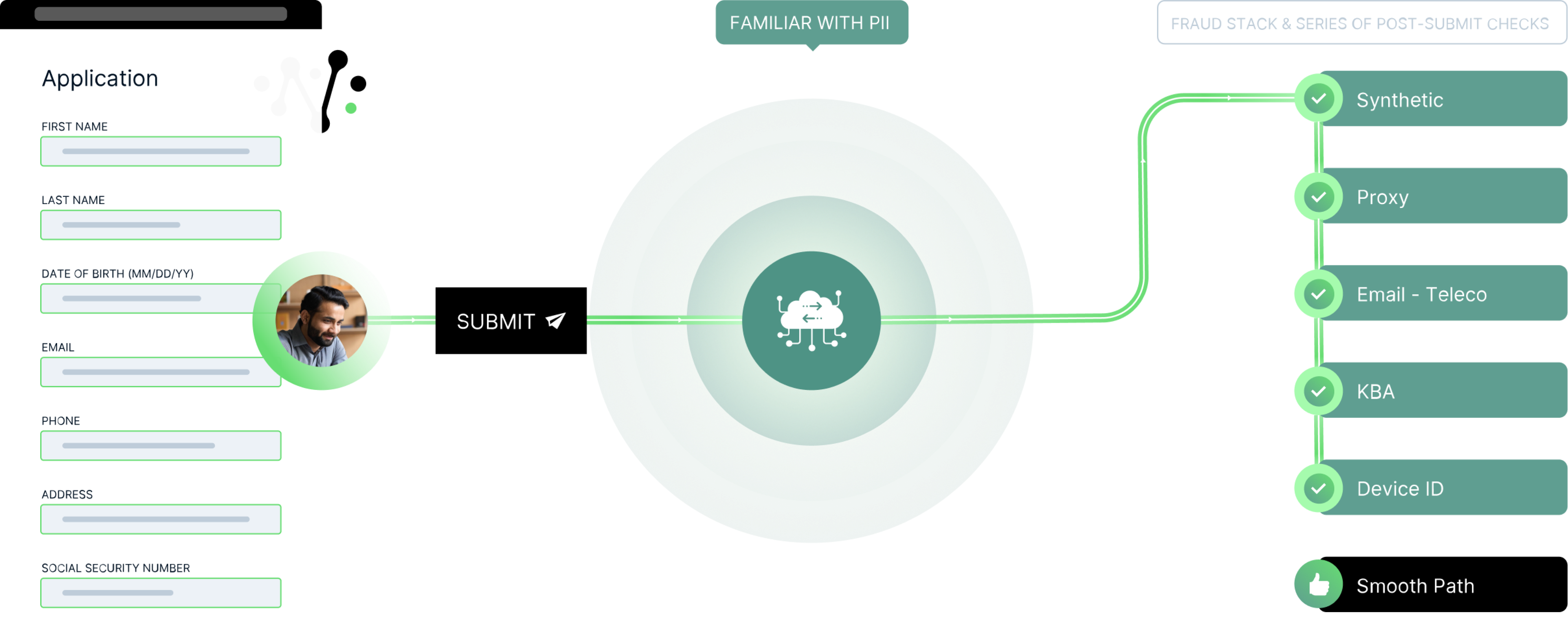

Adding NeuroID’s behavioral analytics as your front-line of defense streamlines the rest of your fraud prevention efforts. We helped Elevate save $1-2M a year through accurate fraud detection and operational efficiency improvements.

Create frictionless workflows & streamlined processes.

NeuroID’s advanced user segmentation and real-time analytics help you create dynamic workflows based on a user’s level of riskiness. This leads to faster verification times for trustworthy users (and more deterministic rejections for fraudsters). You can also better pinpoint stages where users might abandon your process, ensuring smoother experiences.

Digital Lenders Trust NeuroID to Stop Fraud Faster

Elevate

saw visibility into crowd-level behavior that enabled them to see, segment, and be alerted to spikes in fraud ring applicants, bot applicants, and other bad actors.

Addi

closed out several fraud vectors entirely, and improved decisioning for reduced costs of reviews and more accurate rejection at top-of-funnel.

Challenges We Help Lenders Solve

Discover Our Most Popular Resources

Step Up to the Next Generation of Fraud Intelligence

Don’t fall behind the fraudsters. Integrate frictionless behavioral fraud intelligence that protects your entire user lifecycle, from a partner who understands your needs.