Show Your Work: How to Detect Online Fraud using Digital Body Language

Mrs. Paul, my ‘Intro to College Math’ professor, would start every test by saying, “Please remember to show your work.” Math was never my strongest subject and her statement always made me sweat. I remember once asking her, “What does it matter if I show my work as long as I get the answer correct?”

It wasn’t until a few years ago, when I started working with and understanding neuroscience in the digital world, that I realized answers are easy, but how someone gets to the answer can open up another level of insight into that person’s thinking.

These deeper insights power our company mission and product, and we want to share them.

How To Detect Fraud In Online Transactions

A bad actor on the dark web can easily purchase social security numbers, addresses, emails, payment information, and much more. Cybercriminals are using this information to try and fool online merchants each day. Because this data is so readily available it has lessened the efficacy of fraud systems and technologies driven by 3rd party and historic data.

Most online fraud management systems rely on the information entered into a form, application, or payment page to base their analysis on whether the person entering the data is a fraudster or a real prospect. Like in math class, the final answer (in this case, information entered) is only part of the equation to determine genuine customers from fraudulent or risky ones. This approach does not take into account the real-time, current state of the user (or bot!) behind the screen or their intentions.

The natural method and timing of entering personal information into the appropriate fields on a form or checkout page are difficult, if not impossible, to replicate. How a user enters personal information on a website or an app can reveal an incredible amount about that user. The ability to detect potential fraud and understand a person’s digital body language adds a dramatic new layer of intelligence not seen before.

What Is Digital Body Language?

A person’s digital body language – how someone types, taps, or swipes on a mobile device or computer – reveals a lot about their intentions and whether they are a legitimate user or a nefarious fraudster.

Using Digital Body Language To Prevent Online Fraud

Monitoring users’ digital body language when interacting with forms and online applications can help companies reduce fraudulent activity on their sites. When viewed collectively, paying attention to the time it takes to input certain information like any hesitation between form fields, and whether a user is copy and pasting, these minor data points reveal a lot of information about the user, specifically, bad actors.

By looking at these user behaviors, companies can understand a user’s session journey and “field interaction fluency? (how well a user moves from field to field) along with their typing and navigation habits. From this data, businesses can determine the user’s intent (customer vs. criminal) and experience (focus, frustration, confusion, and hesitancy).

Reducing Digital Friction

Sometimes digital body language can tell another story. In the case of the UI (user interface) and UX (user experience) for a company’s website, digital friction is anything that prevents a customer from completing their goal – like completing a form – in the easiest and most efficient way possible. Smart companies leverage behavioral data in their design to cater to site visitors and drive action. The smartest companies also work toward the goal of making the customer’s experience as frictionless as possible.

By looking at these user behaviors, companies can understand a user’s session journey and field interaction fluency along with their typing and navigation habits. From this data, businesses can determine the user’s intent (customer vs. criminal) and experience (focus, frustration, confusion, and hesitancy).”Jack Alton, Nuero-ID CEO

Digital Fraud Detection Done Right

So how do companies protect against fraud while also reducing friction for customers?

First, we need to acknowledge that not all online fraud detection systems are created equal. Many operate with too much restriction, and the subsequent digital friction costs them, real customers. A recent article found that a company can lose more money declining legitimate customers due to a suspicion of fraud in what is called a “false positive” than actual fraud itself. Adding insight-driven behavioral data to your fraud detection platform simultaneously reduces false positives for real customers while also curbing fraudulent activity. The article notes how “[fin tech services ally] Aite Group estimates that the e-commerce industry will experience false-positive losses of $443 billion by 2021, a much larger number than the projected fraud losses of $6.4 billion.”

Fraud Detection To Help You And Your Customers

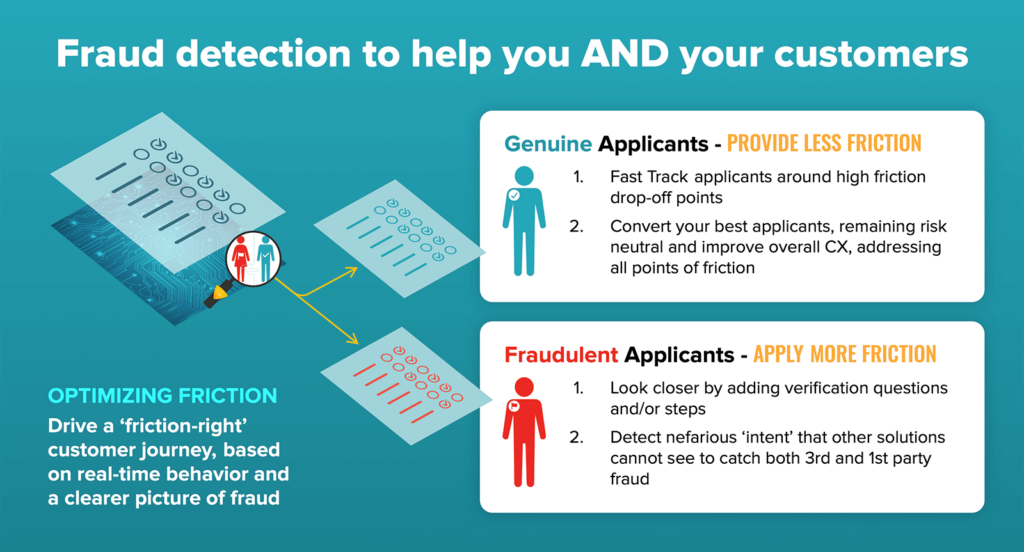

Using digital body language, companies can detect user intent, signals that highlight genuine customers and fraudsters, and leverage that knowledge to both improve the user experience for real users and reduce fraud at the same time.

This enables real-time personalization of the digital customer journey based on both high and low fraud potential:

Genuine Applicants – Provide Less Friction

- Fast track applicants around high friction drop-off points

- Convert your best applicants, remain risk-neutral, address all points of friction, and improve overall CX

Fraudulent Applicants – Apply More Friction

- Look closer by adding verification questions and/or extra steps

- Detect fraudulent “intent” using digital body language that most fraud detection solutions miss

It’s vital to get UX right because denying real customers can mean missing out on significant revenue opportunities for your business in addition to any losses accrued due to fraudulent site activity.

Plus, what company wants to be an irritant to good customers? In addition to the loss of initial revenue, according to a study by the Merchant Risk Council, 33% of customers that are falsely declined will never return to that site.

The costs of false positives are exceedingly high.

3 Ways To Detect Online Fraud Using Digital Body Language

Digital body language translates into actionable insights to detect fraud and friction. Here are three tools within Neuro-ID’s behavioral platform commonly used for fraud detection and friction assessment:

1. Friction Index® Dashboard

- Scientifically measure friction for every question on a website form

2. Neuro-Attributes

- These attributes are tuned to over 300B behavioral signals from 150M customer journeys across multiple industries

- They are predictive and valuable on day one: no tuning is required

3. Neuro Confidence Score (NCS)

- These scores are customized to the outcomes a specific company wants to predict

Learn how to use Digital Body Language to detect fraud >>

Future Applications For Behavioral Data

Adding digital body language as a new layer of behavioral data is critical in fraud mitigation and improved customer experience. It requires no Personally Identifiable Information (PII) or any 3rd party data sources, merely the data captured from the myriad of digital interactions already occurring with organizations every day.

So looking back now, I want to give a big “Thank you” to Mrs. Paul, because I finally got what she meant.